Unlock Your Prospective with Expert Loan Services

Unlock Your Prospective with Expert Loan Services

Blog Article

Discover Reliable Funding Services for All Your Financial Demands

In navigating the vast landscape of financial solutions, locating dependable funding carriers that satisfy your details needs can be an overwhelming job. Whether you are thinking about personal car loans, on the internet loan providers, lending institution, peer-to-peer financing platforms, or entitlement program programs, the options appear unlimited. However, among this sea of choices, the essential inquiry remains - how do you determine the trustworthy and dependable methods from the remainder? Let's check out some key factors to take into consideration when looking for car loan solutions that are not only trusted yet also customized to meet your special economic needs - Loan Service.

Kinds of Individual Loans

When thinking about personal finances, people can select from different kinds customized to satisfy their certain monetary demands. One common kind is the unprotected personal financing, which does not require security and is based on the customer's creditworthiness. These car loans normally have higher rate of interest rates because of the boosted risk for the lender. On the various other hand, safeguarded personal fundings are backed by collateral, such as a car or interest-bearing accounts, resulting in reduced rate of interest as the lending institution has a kind of safety. For individuals looking to settle high-interest financial debts, a debt consolidation loan is a sensible choice. This kind of loan incorporates several debts right into a single regular monthly settlement, commonly with a lower rates of interest. In addition, people looking for funds for home improvements or major acquisitions might choose for a home enhancement car loan. These lendings are especially designed to cover costs connected to enhancing one's home and can be safeguarded or unsecured relying on the lender's terms.

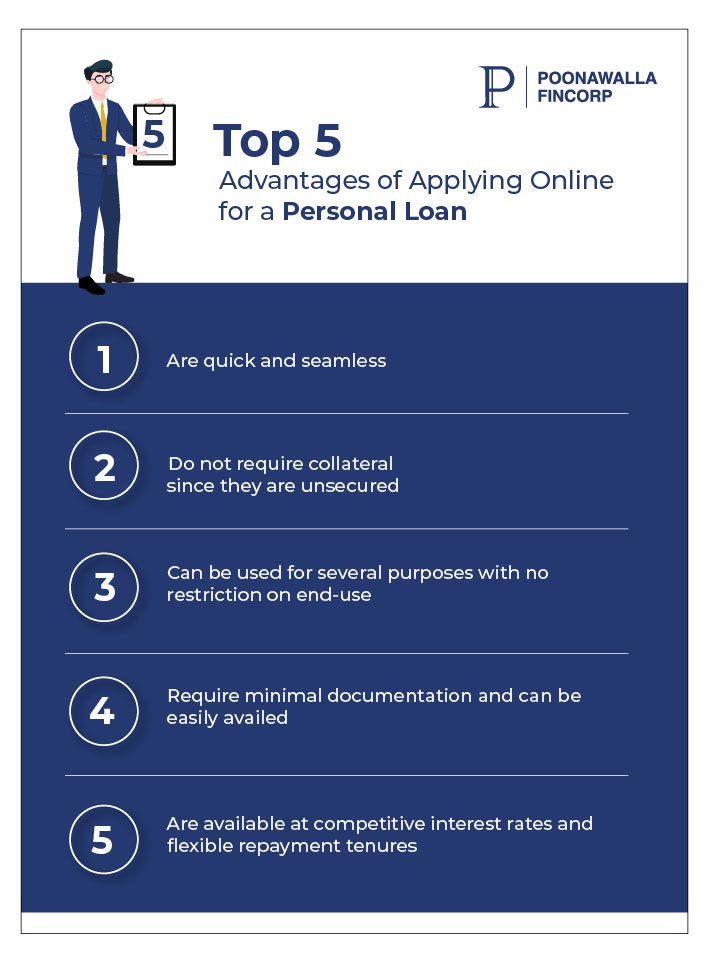

Advantages of Online Lenders

Understanding Credit Score Union Options

Credit report unions are not-for-profit economic cooperatives that offer a variety of items and solutions comparable to those of banks, including cost savings and inspecting accounts, financings, credit scores cards, and much more. This ownership framework commonly equates into reduced fees, competitive interest rates on fundings and cost savings accounts, and a solid emphasis on client solution.

Cooperative credit union can be appealing to individuals searching for a much more individualized technique to financial, as they normally focus on participant fulfillment over revenues. Furthermore, lending institution usually have a strong area visibility and might use monetary education resources to help participants boost their monetary literacy. By understanding the options readily available at credit rating unions, people can make enlightened decisions about where to entrust their economic requirements.

Exploring Peer-to-Peer Lending

One of the vital tourist attractions of peer-to-peer borrowing is the capacity for reduced interest rates compared to conventional monetary organizations, making it an attractive choice for debtors. Furthermore, the application procedure for obtaining a peer-to-peer finance is generally structured and can result in faster accessibility to funds.

Investors likewise gain from peer-to-peer lending by possibly gaining higher returns compared to standard financial investment options. By removing the middleman, financiers can straight money consumers and obtain a section of the interest repayments. Nevertheless, it's vital to note that like any investment, peer-to-peer loaning brings integral threats, such as the possibility of customers skipping on their finances.

Government Support Programs

In the middle of the progressing landscape of monetary services, an essential facet to consider is the realm of Federal government Aid Programs. These programs play a crucial duty in giving financial assistance and assistance to individuals and companies throughout times of requirement. From unemployment insurance to bank loan, entitlement program programs intend to ease monetary concerns and advertise financial stability.

One famous instance of a government help program is the Small company Management (SBA) finances. These finances provide favorable terms and low-interest prices to assist little companies grow and browse difficulties - mca direct lenders. In addition, programs like the Supplemental Nutrition Assistance Program (SNAP) and Temporary Support for Needy Households (TANF) give essential support for individuals and families facing economic hardship

Furthermore, government support programs prolong beyond financial assistance, encompassing Read Full Article housing assistance, healthcare subsidies, and educational gives. These campaigns intend to resolve systemic inequalities, advertise social well-being, and make sure that all residents have access to basic necessities and possibilities for advancement. By leveraging entitlement program programs, people and services can weather monetary storms and strive in the direction of an extra safe monetary future.

Conclusion

Report this page